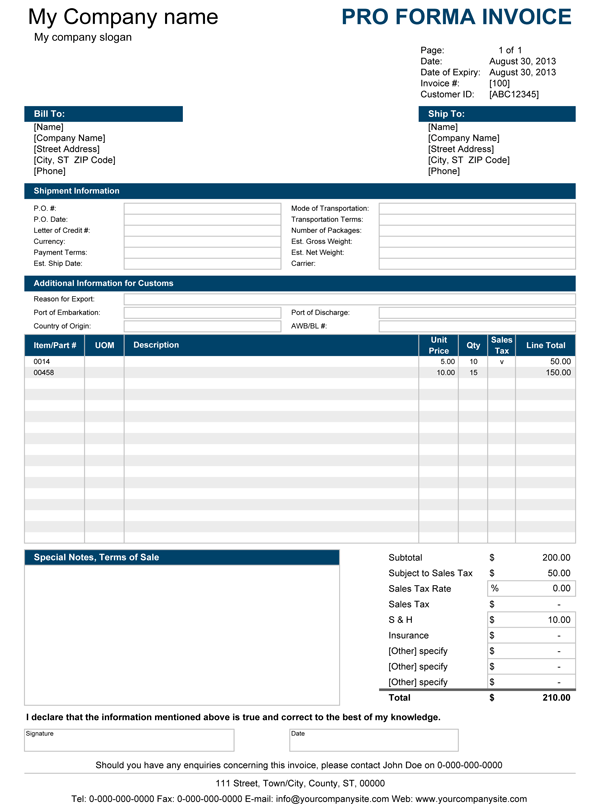

It is an estimate created before the sale is complete and final.

PROFORMA INVOICE PRO

Similarly, the precise terms of a sale are not set in stone with a pro forma invoice either, but it is a more formal document and represents a proposed agreement between the buyer and the seller.

They occur at various stages of the transaction and differ in how legally binding they are.įor example, a price quote is not a binding agreement but simply a way for a seller to detail exactly how much the requested goods or services would cost if the transaction were to be completed. The business world is filled with various types of documents exchanged between buyers and sellers relating to a transaction. Pro forma invoices are as important for customs agents as they are for buyers and sellers, as they allow customs to determine what duty fees are required based on the goods included in a shipment. The phrase pro forma comes from a Latin phrase meaning 'for the sake of form,' and they're often used in international transactions to help shipments pass smoothly through customs and ensure successful transactions without any major hangups. While pro forma invoices tend to follow the same general template, there are no standardized or legally regulated guidelines that dictate exactly how a pro forma invoice should be formatted, presented, or written. The information found on a pro forma invoice can vary, but it will generally include the following:ĭue date or payment terms, for example, payment will be due 30 days from receipt

In business, a pro forma invoice, also referred to as a proforma invoice, is a preliminary bill of sale (a document detailing a transaction) sent from a seller to a buyer before a shipment or delivery of goods arrives.

0 kommentar(er)

0 kommentar(er)